starting credit score canada

Where does my score come from. Accepting an increase in your credit limit will lower your credit usage percentage immediately.

Understanding Your Credit Score And Why It Matters Envision Financial

The higher the score the less of a risk one is considered to be.

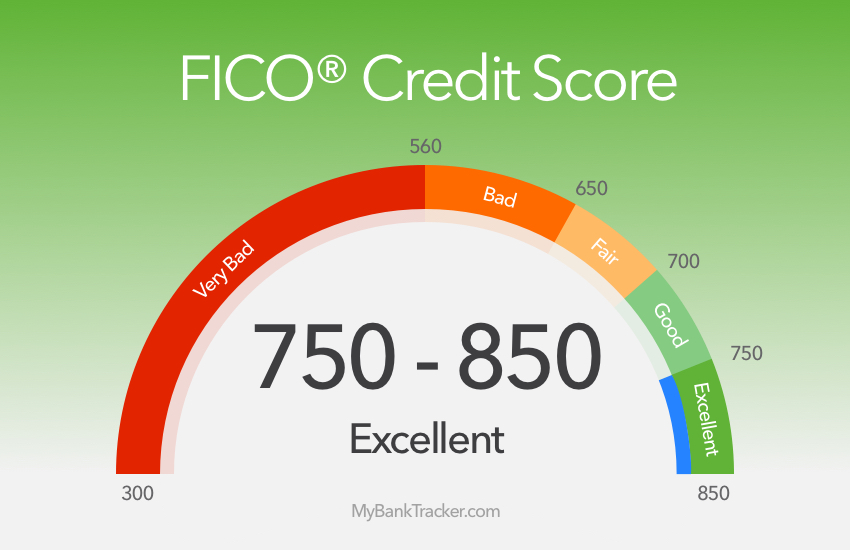

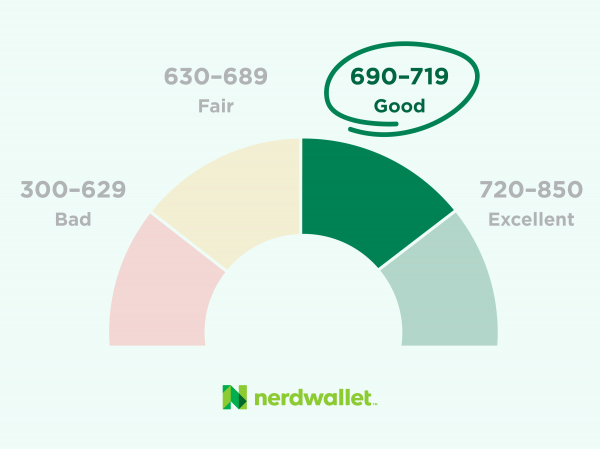

. Scores above 660 typically mean youre low-risk and shouldnt have trouble getting approved for credit. A score under 650 will likely make it more difficult to acquire first time credit. Credit scores range from 300 just getting started 650 the magic middle number which will likely qualify you for a standard loan all the way up to 900 points the highest score.

1 What is a credit score in Canada. Your credit score is a number between 300 and 900 that tells lenders in Canada how trustworthy you are as a borrower. Checking for errors on your credit report.

My credit score was 764 last June I applied for a credit card but my application got declined Idk whyI lost 10 points then the credit score started dropping down by 15 points in July 23 points in August and about 17 points in September till this moment I have an outstanding auto loan for 62000 and 300 credit crad I usually pay off. Heres how it works. We use 128-bit encryption to protect the transmission of your data to our site.

If you want to. Dont worry if you dont get there within a month or two. A credit score of 760 and above is generally considered to be an excellent credit score.

Cybercriminals Find New Ways to Steal Identities. However when you order your credit score it may be different from the score produced for a lender. Open a bank account.

Canadian credit scores vary between 300 to 900 and represent your likelihood to repay debt on time. Your security is a priority. If youve never had credit activity a credit card or loan or instance you wont start at 300.

How long information stays on your credit report. A credit score is a three-digit number given based on the sort of credit extended by and payments made to lenders. Pay your bills on time.

In Canada according to Equifax a good credit score is usually between 660 to 724. Once you have credit the single biggest thing you can do to improve your credit score in. Finding and fixing errors on your credit report and protecting yourself from fraud.

Ok So What Is a Good Credit Score. If youre carrying a balance of 5000 on a card with a 10k limit your usage percentage is 50. Reading more about Canadian credit bureaus may help you understand how they differ from what you may be used to.

This may seem somewhat obvious but youre not going to be able to improve your credit score in. Your credit score an all-important number ranging from 300 to 900 tells lenders in Canada how trustworthy you are and whether you deserve a good deal on a credit card mortgage car loan or personal loan. Credit articles and education.

Your credit scores are calculated. The higher your score the more likely youll get approved for credit and at lower interest rates too. 2 The credit score range is anywhere between 300 to 900.

We treat your data like its our own. How to improve credit score Canada 1. Easily Dispute Any Errors In Your Credit Report.

TransUnion suggests that you should be able to qualify for a loan if you have a credit score above 650 as compared to an uch is the magic middle number a score above 650 will likely qualify you for a standard loan while a score under 650 will likely bring difficulty in. Your credit score will be used by lenders and others to determine whether or not. In Canada credit scores range from 300 very poor to 900 excellent with the average Canadian credit score sitting at 650.

In Canada your credit score refers to a three-digit number usually between 300 and 900 that indicates your creditworthiness In other words its a kind of report card on how good you are at managing debt and financial responsibility. Ad Get Your Credit Score in Less Than 3 minutes. Your credit score an all-important number ranging from 300 to 900 tells lenders in Canada how trustworthy you are and whether you deserve a good deal on a mortgage credit card car loan or personal loan.

If you have your limit increased to 15k your usage percentage is now around 33. Your credit score is a three-digit number between 300 and 900 that represents your credit risk. Why Pay 1 or Sign Up For A Trial When You Can Get Your Score For Free - Every Week.

What is the credit score range in Canada. While both share FICOs common credit score model the average credit score in Canada is 650 while the USs average score is 704. Ad Includes Full Instant Access To Your Report Score Plus Credit Monitoring Simulation.

Its essential to keep your score on the higher end of the scale but where do you start off. Ad LifeLock Alerts You to Activity Around Your Social Security Number in Their Network. There are two main credit bureaus in Canada.

Anything over 660 is considered good and the ideal level you want to achieve is around 800 points. The top score in Canada is 900 points which is about the level of credit you can get at any time. Checking Wont Impact Your Score.

This is because a lender may give more weight to certain information when calculating your credit score. Credit risk is the likelihood youll pay your bills on time or pay back a loan on the terms agreed upon. Pay even the minimum.

For example Canadian credit scores range from 300-900 while US credit scores range from 300-850. The best advice is to go into a. The higher your score the lower the risk is to the bank.

Without even lowering your balance youve. Ad See Your Free Credit Score and Get Critical Alerts with Chase Credit Journey. Who creates your credit report and credit score.

In Canada credit scores can be as high as 900 and as low as 300 but dont worry. Credit scores are a number between 300 and 900 that serve as a reflection of your credit report and trustworthiness. Your credit score is determined by factors like the number and types of bank accounts you have your credit history used versus available credit and payment history.

Sign Up for a 30 Day Trial Today. 2 The higher your score the better your credit rating. Well a credit score is generally in the 300 to 900 range.

How long credit bureaus can keep information that may affect your credit score. Your free credit score and report. If your credit score is between 725 to 759 its likely to be considered very good.

Rebuild Your Credit Score With Prepaid Debit Cards Prepaid Debit Cards Credit Score Credit Solutions

What Is A Good Credit Score Forbes Advisor

How To Improve Your Credit Score Lendingtree

What Is A Good Credit Score Forbes Advisor

How To Improve Your Credit Score Forbes Advisor

Grow Credit Review Starter Credit Card To Build Credit In 2022 Credit Review Build Credit Credit Card Design

How To Improve Credit Score 100 Points Fast Improve Credit Score Improve Credit Increasing Credit Score

How To Improve Credit Score 100 Points Fast Improve Credit Improve Credit Score Bad Credit Personal Loans

Ask An Expert Why Don T I Have A Perfect Credit Score Nfcc

What S Considered A Good Credit Score Transunion

Start Improving Your Credit Score In The Next 6 Months Improve Your Credit Score Check Credit Score Improve Credit Score

Raise Credit Score Quickly Credit Score Improve Credit Score What Is Credit Score

Corporate Lending Http Www Eternalkeyinvestmentsllc Com Credit Credit Repair Commercial Loans What Is Credit Score

700 Credit Score Is It Good Or Bad How To Build Higher Nerdwallet

The Question Isn T Who Is Going To Let Me It S Who Is Going To Stop Me Ayn Rand Channel Some Of Credit Repair Services Improve Your Credit Score Credits